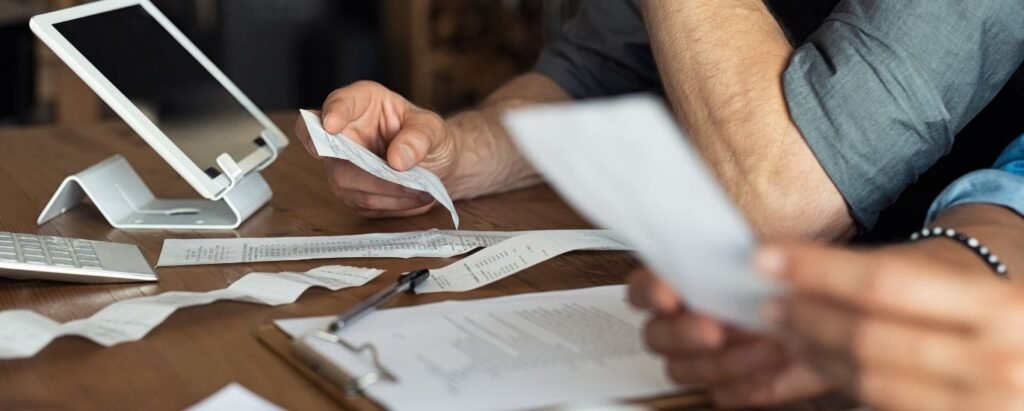

Running a business is undeniably exciting, but managing finances? Not so much. Accounting mistakes are one of the most common issues entrepreneurs face—and they can quietly snowball into serious problems if left unchecked. While it’s never fun to think about mistakes, being aware of potential pitfalls is the first step to avoiding them.

Let’s dive into five frequent accounting mistakes businesses make and, more importantly, how you can avoid them.

Table of Contents

ToggleNot Separating Personal and Business Finances

For small business owners and startups, blending personal and business finances is a common misstep. It may seem harmless at first—after all, it’s your business. But as time goes on, blurred lines make it nearly impossible to track expenses, calculate profits, or claim tax deductions accurately.

Picture this: you’re trying to separate months of personal coffee purchases from actual client meetings or distinguish software subscriptions from personal apps. Not only is it a waste of time, but it can also raise red flags during tax season.

How to Avoid It

The solution is simple: open a separate business bank account and credit card. This keeps your transactions clean and organized. Use accounting software like QuickBooks or Xero to automate expense categorization. When everything is properly sorted, you’ll save time during tax season and have a clear snapshot of your financial health.

Overlooking Small Expenses

Small expenses—like a $10 app subscription or a quick lunch meeting—might seem insignificant. But over time, these little costs add up and can distort your understanding of your operating expenses. Worse, failing to track them means you could miss valuable tax deductions.

How to Avoid It

Make it a habit to record every expense, no matter how small. Tools like Expensify or Xero allow you to snap a photo of receipts and log expenses on the go. By consistently tracking every dollar, you’ll have a better handle on your spending and uncover opportunities to optimize your budget.

Misclassifying Expenses

Misclassifying expenses is an easy mistake with costly consequences. For example, incorrectly categorizing a consultant’s fee as “office supplies” skews your financial reports and makes it harder to track spending accurately.

How to Avoid It

Invest in reliable accounting software that automates expense classification based on your preferences. If your budget allows, hire a bookkeeper to ensure everything is categorized correctly. Make it a point to regularly review your financial statements to spot errors early. If you’re unsure about any classification, consult an accountant to avoid penalties or confusion later.

Skipping Regular Financial Reconciliation

Reconciling your accounts might sound tedious, but skipping this step can lead to significant issues. Financial reconciliation involves matching your business records (like receipts and invoices) with your bank statements to ensure everything aligns.

When businesses neglect this process, they risk missing errors such as duplicate payments, unauthorized charges, or bounced checks—all of which can snowball into costly mistakes.

How to Avoid It

Set aside time each month to reconcile your accounts—it’s as essential as paying bills or running payroll. Use modern accounting tools to streamline the process by automatically importing and matching transactions. For growing businesses, outsourcing reconciliation to a professional accountant can ensure accuracy and save time.

Relying Too Heavily on Manual Accounting

Manual accounting might seem cost-effective, but relying on spreadsheets can do more harm than good. Human error—like forgetting to update a cell or inputting the wrong formula—can result in inaccurate reports, cash flow issues, or missed tax deadlines.

Think about it: a misplaced decimal point can turn a $1,000 profit into a $100 loss on paper.

How to Avoid It

Automate wherever possible. Cloud-based accounting software like QuickBooks, Zoho Books, or Wave can handle calculations, expense tracking, and report generation in real time. Automation minimizes errors and saves you valuable hours so you can focus on growing your business while your finances run smoothly in the background.

Additional Tips to Improve Accounting Practices

Here are some additional recommendations to improve your accounting procedures even more:

- Invest in Training: Take into account receiving rudimentary instruction in accounting principles if you or your employees perform accounting duties. Costly mistakes can be avoided by knowing the fundamentals.

- Establish Clear Policies: To ensure uniformity, set rules for record-keeping, reimbursements, and cost approvals.

- Audit Frequently: Arrange for recurring internal audits to guarantee compliance and identify errors early.

- Leverage Technology: Automate tedious processes like bank reconciliations, payroll, and invoicing by using accounting software and tools.

Take Control of Your Accounting

Accounting doesn’t have to be overwhelming or stressful. By addressing these common mistakes—mixing personal and business finances, neglecting small expenses, misclassifying costs, skipping reconciliation, and relying too heavily on manual processes—you can take control of your finances and set your business up for success.

Modern accounting tools and good financial habits not only keep you organized but also provide powerful insights into your business’s performance. And if you’re ever unsure, don’t hesitate to bring in a professional accountant for guidance.

In the end, avoiding these errors will keep your business financially healthy, compliant, and ready for growth. Start tackling these mistakes today—your future self will thank you.

Frequently Asked Questions (FAQs)

The most common accounting mistakes include mixing personal and business finances, failing to track small expenses, misclassifying expenses, neglecting reconciliation, and relying too much on manual accounting.

Separating finances makes it easier to track business expenses, manage cash flow, and file accurate tax returns without confusion or errors.

Use accounting software or mobile apps like Expensify or QuickBooks to log expenses in real time. Keeping receipts and reviewing your accounts regularly also helps.

Financial reconciliation is the process of matching your records to your bank statements to identify and correct errors, such as missed payments or unauthorized charges. It ensures your financial data is accurate.

Use accounting software to automate categorization, and consult with a bookkeeper or accountant to ensure expenses are correctly classified. Regularly reviewing your financial reports also helps.